Moderate-income homeownership is an important element of affordable housing. Arlington County’s Affordable Housing Master Plan (AHMP) cites the needs for a sufficient supply of housing for individuals or households to own; opportunities for moderate-income first-time homebuyers; and support for older Arlingtonians, many of whom are homeowners. The AHMP 2022 Implementation Framework directs County staff to develop a new approach to homeownership program implementation.

The Homeownership Study is an initial step in developing this new approach in light of changing market conditions, as well as in examining how homeownership programs can further the County-wide priority to eliminate, reduce, and prevent racial disparities.

The following background information is taken from Analysis of Ownership Housing and Barriers to Homeownership in Arlington County, published in October 2022. Read the full Barriers Analysis here.

Close to half of Arlington’s housing stock (49.6%) consists of apartments.

Arlington County Housing Stock, 2022

Since ownership rates in any community depend on the existing housing stock, as well as the financial capabilities of community members, Arlington has a majority of renters, with a homeownership rate of 43.9%. Although the number of homeowners in the County has increased over the past decade, homeownership rates have decreased, because the market has produced mostly rental housing. Yet, the ownership rate in Arlington is comparable to the City of Alexandria (43.2%) and the District of Columbia (41.6%).

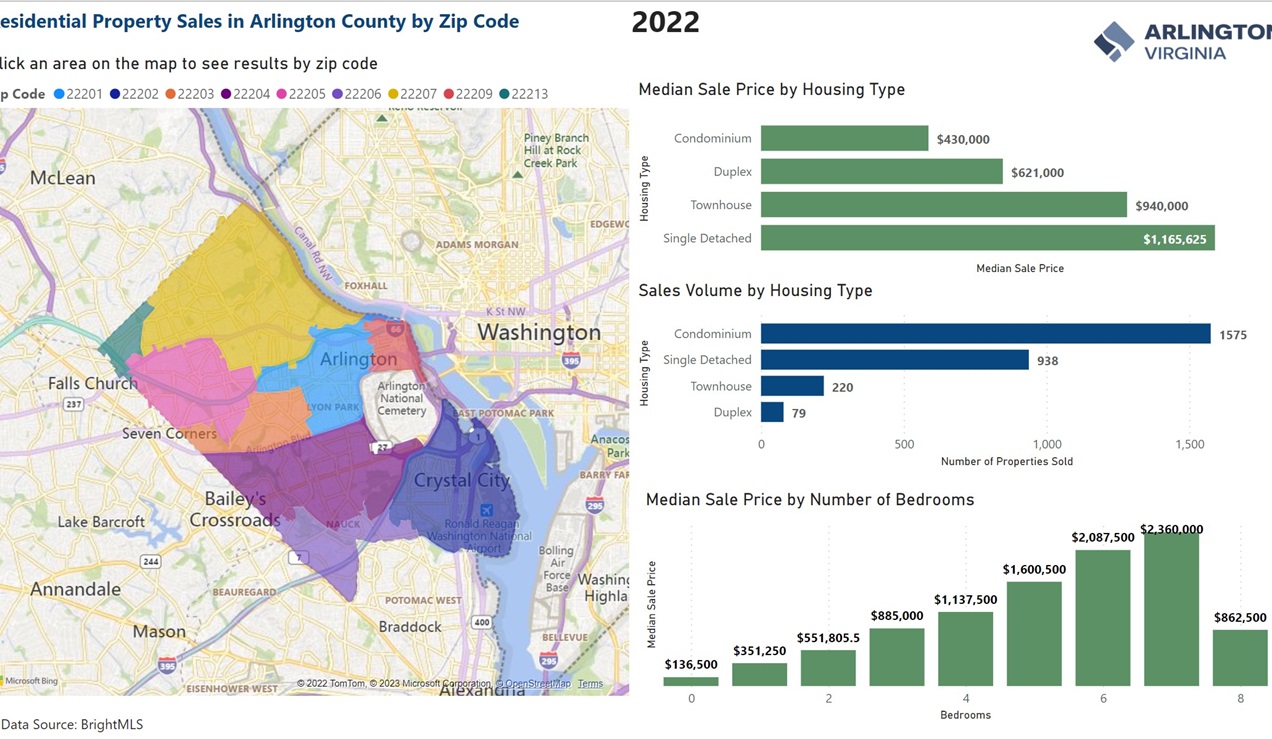

Click on the image below to open a new tab containing interactive tables and maps. Use them to drill down into data about residential property sales in Arlington County.

Here are a few practice questions to help you get started using the tables and maps.

Which Arlington zip code had the highest volume of condo sales in 2022?

22201

How many sales of 2-BR condos occurred in Arlington in 2022?

757

Which type of condo structure saw the highest volume of sales at or under $500,000 in zip code 22204 in 2022?

Condo Garden

Although any home purchase is influenced by an infinite combination of variables, a constantly changing market, and each buyer’s needs and preferences, the National Housing Conference annually publishes the “Paycheck-to-Paycheck” report and dataset, which demonstrate the income needed in housing markets nationwide to purchase housing, and the median salaries for various professions in those markets.

At the "Paycheck-to-Paycheck" website, you can select a metropolitan area and up to 10 professions, to gain a sense of the home-purchasing potential of members of those professions. Arlington County is part of the Washington-Arlington-Alexandria, DC-VA-MD-WV area.

Open "Paycheck-to-Paycheck" Chart Generator

As an example, the chart below shows the estimated income needed in mid-September 2022 to purchase the median-priced home ($529,871) in the Washington, DC, metropolitan region with down payments of 10% and 3%, with an interest rate of 3.85%. Median salaries of several illustrative professions are also shown.

It should be noted that while disparities are observable by race and ethnicity, other factors, such as income, that have strong correlations with race and ethnicity likely contribute to the observed disparities.

Homeownership

Although the average homeownership rate for a resident of Arlington is 43.9%, homeownership rates vary widely between racial and ethnic demographic groups.

The homeownership rate for white (non-Hispanic or Latino) households is above the average, at 49%, while the ownership rate for Asian households is 35%; for Hispanic or Latino households, 29%; and for Black or African American households, 21%.

Loan Origination

Despite the limitations of Home Mortgage Disclosure Act (HMDA) data (e.g., inability to control for multiple applications for financing by the same applicant, and lack of data on the race or ethnicity of the applicant in close to a quarter of cases), we can see clear disparities in origination and denial rates for mortgage loan applications for purchases of primary residences in Arlington.

Arlington Mortgage Loan Applications for Purchases of Primary Residences by Race & Ethnicity

| Race / Ethnicity of Applicant |

Applications Reported |

Applications Denied |

Denial Rate |

Loans Originated |

Origination Rate |

| White (Not Hispanic) |

2,187 |

60 |

2.7% |

1,797 |

82% |

|

All Applications

|

3,902 |

127 |

3.3% |

3,113 |

80% |

| Asian |

407 |

16 |

3.9% |

313 |

77% |

|

Hispanic or Latino

|

209 |

15 |

7.2% |

160 |

77% |

| Black or African American |

140 |

13 |

9.3% |

96 |

69% |

| Race Not Available |

959 |

23 |

2.4% |

747 |

78% |

Source: Consumer Financial Protection Bureau, HMDA 2021

The overall denial rate for applicants purchasing in Arlington in 2021 was 3.3%. The denial rate for white applicants, however, was lower than the average, at 2.7%, while the denial rates were above the average for Asian (3.9%), Hispanic or Latino (7.2%), and Black or African American (9.3%) applicants.

Interest Rate

The “rate spread” refers to the difference between a loan’s annual percentage rate (APR) and the average prime offer rate for a comparable transaction. The rate spread is a more accurate way of analyzing differences in interest rates on mortgages than the average interest rate because interest rates change constantly.

Rate Spread for 30-Year Mortgages in Arlington & Income by Race/Ethnicity of Borrower

| Race / Ethnicity of Borrower |

Number of Loans |

Share of Loans |

Average Interest Rate |

Rate Spread |

Average Income |

| Asian |

287 |

10% |

2.88 |

0.01 |

$187,000 |

| White (Not Hispanic) |

1,728 |

58% |

2.90 |

0.03 |

$210,000 |

|

All Loans

|

2,975 |

|

2.90 |

0.05 |

$210,000 |

|

Hispanic or Latino

|

151 |

5% |

2.93 |

0.11 |

$148,000 |

| Black or African American |

92 |

3% |

2.93 |

0.21 |

$174,000 |

| Race Not Available |

717 |

24% |

2.94 |

0.06 |

$229,000 |

Source: Consumer Financial Protection Bureau, HMDA 2021

The average rate spread for all 30-year mortgages originated in Arlington in 2021 was 0.05. The average rate spread for white borrowers was below the County average, at 0.03, while the average rate spreads for Hispanic or Latino borrowers (0.11) and for Black or African American borrowers (0.21) were higher than the County average. (The average rate spread for Asian borrowers was below the County average, at 0.01.)

Access to Refinancing

In 2021, more than two thirds of all Arlington mortgages originated were related to refinancing of existing residences, as homeowners took advantage of historically low interest rates. Application denial rates for refinancing were much greater than for home purchases and demonstrated disparities along racial and ethnic lines.

Arlington Mortgage Applications by Race & Ethnicity

| Race / Ethnicity of Applicant |

Applications Reported |

Applications Denied |

Denial Rate |

Loans Originated |

Origination Rate |

| White (Not Hispanic) |

5,866 |

347 |

5.92% |

4,135 |

70% |

|

All Applications

|

11,373 |

700 |

6.15% |

6,779 |

60% |

| Asian |

728 |

63 |

8.65% |

456 |

63% |

| Black or African American |

293 |

37 |

12.63% |

172 |

59% |

|

Hispanic or Latino

|

496 |

70 |

14.11% |

271 |

55% |

| Race Not Available |

3,990 |

183 |

4.59% |

1,745 |

44% |

Source: Consumer Financial Protection Bureau, HMDA 2021

You can read more about ownership rates, the local housing market, and financing in Analysis of Ownership Housing and Barriers to Homeownership in Arlington County.

Read the Barriers Analysis